Do Your Beneficiary Designations Coordinate with Your Will?

Many people fear the word probate, and it is not without reason. Probate can be a tedious, expensive and lengthy process, where you are at the whim of the court’s timeline. But what is probate? Probate is when you must petition the court for authority to deal with a deceased loved one’s probate assets, which are assets in one’s personal name at death that do not pass by beneficiary designation or joint ownership. In the rush to avoid probate, many people name beneficiaries on assets, but that can have disastrous effects on your testamentary intent.

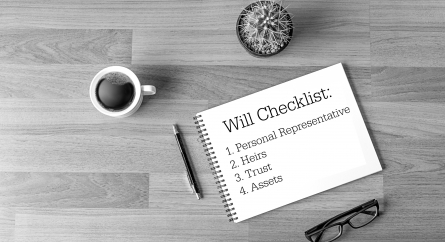

Your will governs the administration of your probate assets and only your probate assets (i.e., it will not affect assets that have beneficiaries named, such has retirement accounts or life insurance). If you have several bequests contained in your will, however, it is essential that you have assets flowing into your estate in order to fund those bequests. This means that you need to have probate assets and that you should not be naming beneficiaries on your assets. Your estate will need assets to satisfy bequests but also to pay administrative expenses and possibly estate and income taxes.

Let’s look at an example: Sarah has a will that makes a $700,000 bequest to her favorite charity, $50,000 to her cousin, $50,000 to each of her nieces and nephews and the residue to her brother. Sarah has named her brother as her nominated Personal Representative and she has named her brother as the beneficiary of all of her assets, thinking cleverly that she will avoid probate, and her brother will follow her wishes. She trusts him implicitly.

The best-case scenario when Sarah dies is that her brother is alive, competent and honorable. In that case, he will make the “bequests,” which will actually constitute gifts from him, and he will have to file a gift tax return for himself reporting the gifts. These gifts will reduce his personal lifetime federal estate tax exemption.

The worst-case scenario is that the brother is alive, but not competent or not trustworthy. In that instance, he retains all of the assets and none of the bequests are satisfied. After all, he is under no obligation to give assets away that have rightfully passed into his individual name (and not as Personal Representative, which carries with it fiduciary obligations).

What if the brother predeceases Sarah, and the beneficiary designation forms indicate that her assets pass to his children who are minors or have no knowledge of Sarah’s clever handshake deal with her brother?

If your assets do not coordinate with your estate plan, including your will, then your testamentary intent will be frustrated. It is vital to get advice from an attorney to make sure your wishes will be followed and so that the substantial time and expense of having a will prepared is not wasted.

Tagged In: beneficiary designation, estate plan, probate assets, testamentary intent